American Collectors Insurance--- Strongly consider this!

#51

Yup, I know of someone filing a quite large claim with American with many additions/supplements and they were awesome---- everything went without a hitch and the car was fixed better than new. The final claim was high enough that if this had been standard insurance the car would have been totaled like twice over.

You can't go wrong in my experience

You can't go wrong in my experience

#52

Junior Member

Good read, everybody. Thanks for the tips. Hagerty was the only company I'd dealt with before...but now I see I have a lot more good options when I finally find my FD!

The following users liked this post:

asesereker (05-13-19)

#53

I started using an Insurance broker for my my home and auto needs. Best decision I've made as far as Insurance goes. They do all the shopping, paperwork and are there to help if I need to file a claim.

I've got an agreed value on my 7 valued at $20,000 and I only pay $240/year. Only stipulations are that its garage kept and its not my primary vehicle. Also it has no mileage restrictions which is a plus. I haven't had to file a claim (knock on wood) so I can not speak to that account but so far have been very happy with my situation.

For all others out there, look into an agreed value and shop insurance every 2 years; its just good practice.

Happy motoring

I've got an agreed value on my 7 valued at $20,000 and I only pay $240/year. Only stipulations are that its garage kept and its not my primary vehicle. Also it has no mileage restrictions which is a plus. I haven't had to file a claim (knock on wood) so I can not speak to that account but so far have been very happy with my situation.

For all others out there, look into an agreed value and shop insurance every 2 years; its just good practice.

Happy motoring

#54

Just wanted to update on this. I got off the phone with david at extesion 221.

my FD with mods and what not came out to be 450 annually with a agreeed apon value of 25k. Combine with my 93 Mr2 at value of 10k. Came out to be 650. Annully for both cars

seems like a no brainer for me . I have allstate and im paying 710 for both every 6 months with limited mileage and limited market value. Thanks rich for bringing this up

my FD with mods and what not came out to be 450 annually with a agreeed apon value of 25k. Combine with my 93 Mr2 at value of 10k. Came out to be 650. Annully for both cars

seems like a no brainer for me . I have allstate and im paying 710 for both every 6 months with limited mileage and limited market value. Thanks rich for bringing this up

#55

^ did you get the same coverage as with All State? When i was getting a quote online I had to answer a bunch of questions. I should prob print off the coverage i have with Geico and then talk to American Collectors.

Is this the phone number you called, (800) 360-2277?

Is this the phone number you called, (800) 360-2277?

#56

RX-7 Bad Ass

iTrader: (55)

Been needing to look into this a while. All our cars are insured with USAA, and out of curiosity I wanted to see if USAA has a collector car policy. They do - through American Collectors!

Through the USAA site it linked to American Collectors and I went through for a quote. For a $30,000 agreed value, $1000 deductibles, it was about $600 per year. Right now I'm paying $360 for 6 months ($500 deductible though) on the FD. So this would be more and better coverage and for less. Win!

I'll have to pursue this. It's also interesting that USAA uses them for collector car insurance, that's a REALLY good sign, USAA is typically top quality for insurance companies and they only partner with other quality companies.

Dale

Through the USAA site it linked to American Collectors and I went through for a quote. For a $30,000 agreed value, $1000 deductibles, it was about $600 per year. Right now I'm paying $360 for 6 months ($500 deductible though) on the FD. So this would be more and better coverage and for less. Win!

I'll have to pursue this. It's also interesting that USAA uses them for collector car insurance, that's a REALLY good sign, USAA is typically top quality for insurance companies and they only partner with other quality companies.

Dale

#57

FYI, (800) 360-2277 extension 221 doesn't get you to David.

And it looks like the cars have to be in a locked garage for them to cover you.

And man, i feel like I'm paying a lot for insurance. I think it's costing me like $2k every 6 months h to cover my vehicles which currently includes:

- 04 Rx8 - full coverage

- 93 Rx7 - full coverage

- 79 Rx7 - liability

- 74 REPU - full coverage

- 01 4runner - full coverage

And it looks like the cars have to be in a locked garage for them to cover you.

And man, i feel like I'm paying a lot for insurance. I think it's costing me like $2k every 6 months h to cover my vehicles which currently includes:

- 04 Rx8 - full coverage

- 93 Rx7 - full coverage

- 79 Rx7 - liability

- 74 REPU - full coverage

- 01 4runner - full coverage

#58

RX-7 Bad Ass

iTrader: (55)

When I did my quote online, it did have other storage options - carport, airplane hangar, etc. Fortunately I do have it in a locked garage.

Dale

Dale

#60

Just got my blk FD insured for $25k, which cost me $676 a year, a $400 a year savings.

Coverages include bodily injuries 50k per person, 100k per occurrence, 15k property damage.

Coverages include bodily injuries 50k per person, 100k per occurrence, 15k property damage.

The following users liked this post:

GoodfellaFD3S (02-20-18)

#63

FYI, (800) 360-2277 extension 221 doesn't get you to David.

And it looks like the cars have to be in a locked garage for them to cover you.

And man, i feel like I'm paying a lot for insurance. I think it's costing me like $2k every 6 months h to cover my vehicles which currently includes:

- 04 Rx8 - full coverage

- 93 Rx7 - full coverage

- 79 Rx7 - liability

- 74 REPU - full coverage

- 01 4runner - full coverage

And it looks like the cars have to be in a locked garage for them to cover you.

And man, i feel like I'm paying a lot for insurance. I think it's costing me like $2k every 6 months h to cover my vehicles which currently includes:

- 04 Rx8 - full coverage

- 93 Rx7 - full coverage

- 79 Rx7 - liability

- 74 REPU - full coverage

- 01 4runner - full coverage

640 a year up front payment and my FD is covered for 25k value with 0 deductible and 10k on my 93 mr2 same coverage

they are great

The following users liked this post:

Jonnybravo408 (02-22-18)

#66

ive had Grundy for over 15 years now. I did have a claim for a minor hit and they were very generous even knowing I was repairing the car myself

they also offer a daily driver agreed value policy which is nice if you have a very good condition or rising value "daily" car

couple photos and an application and that was it

yes you are expected to have a daily driver for each member of the household no older then xx years

not supposed to be using this for errands, to and from shows and repairs- but no mileage limitations

expected to keep it garaged

age restriction- I think it was 25

some of these things may have changed as its been a while. Nice thing is once you are in the system you just call and add vehicles. Very easy. I also have a jeep insured but that is with JC Taylor because grundy didnt take "off road vehicles"- again this may have changed but I only pay $85 annually for the jeep

they also offer a daily driver agreed value policy which is nice if you have a very good condition or rising value "daily" car

couple photos and an application and that was it

yes you are expected to have a daily driver for each member of the household no older then xx years

not supposed to be using this for errands, to and from shows and repairs- but no mileage limitations

expected to keep it garaged

age restriction- I think it was 25

some of these things may have changed as its been a while. Nice thing is once you are in the system you just call and add vehicles. Very easy. I also have a jeep insured but that is with JC Taylor because grundy didnt take "off road vehicles"- again this may have changed but I only pay $85 annually for the jeep

#68

Full Member

Wanted to go ahead and revive this one. I only found out about this company through your original post GoodFella (which I just gave you a thanks for). My 7 was coming in at around $630 a year with farmers for JUST liability and comp coverage at 50/100/50. Called and spoke to Robert at ACI and now I've got full coverage with a value of $20k at 50/100/25, $0 deductible on comp / $1,000 on collision, & up to $100 a year in towing reimbursed if needed for $463/year. No brainer compared to Farmer's. This includes 5,000 miles of driving per year (although this cannot be your daily driver.. or even frequent driver).

Their coverage is intended to be for once a month drive (averaged over the year). Any more and it bumps you into the "flex plan" which was going to be about $320 more a year. Even if it was though, that would still have been way better then Farmer's was. I'm extremely happy and Robert was awesome to deal with. Thanks for pointing us towards this!

Their coverage is intended to be for once a month drive (averaged over the year). Any more and it bumps you into the "flex plan" which was going to be about $320 more a year. Even if it was though, that would still have been way better then Farmer's was. I'm extremely happy and Robert was awesome to deal with. Thanks for pointing us towards this!

#70

Senior Member

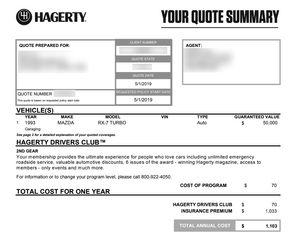

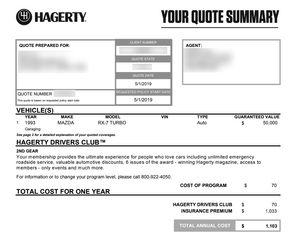

Okay, maybe y'all can help me out. I got a quote from Hagerty's through my Farmer's agent. It doesn't seem to be that great a deal.

What would be the benefit of this for me? I'm currently paying about $800 a year for similar coverage but with only $30,000 or so appraised value.

I will contact American Collectors Insurance next as well of course.

What would be the benefit of this for me? I'm currently paying about $800 a year for similar coverage but with only $30,000 or so appraised value.

I will contact American Collectors Insurance next as well of course.

#71

Okay, maybe y'all can help me out. I got a quote from Hagerty's through my Farmer's agent. It doesn't seem to be that great a deal.

What would be the benefit of this for me? I'm currently paying about $800 a year for similar coverage but with only $30,000 or so appraised value.

I will contact American Collectors Insurance next as well of course.

What would be the benefit of this for me? I'm currently paying about $800 a year for similar coverage but with only $30,000 or so appraised value.

I will contact American Collectors Insurance next as well of course.

More importantly, your current "appraised value" of $30K is likely stated value insurance, which is basically the same as standard auto insurance where the insurer determines the actual depreciated cash value as of the date of loss.

This quote is for an "agreed value" policy, which pays the full amount in the event of total loss, with no allowance for depreciation at all.

I agree, the premium seems a little on the high side, but lots of things, including your location, driving record, loss history, and even your credit score can affect premiums.

Thread

Thread Starter

Forum

Replies

Last Post